Silicon Valley Death Vigil Begins

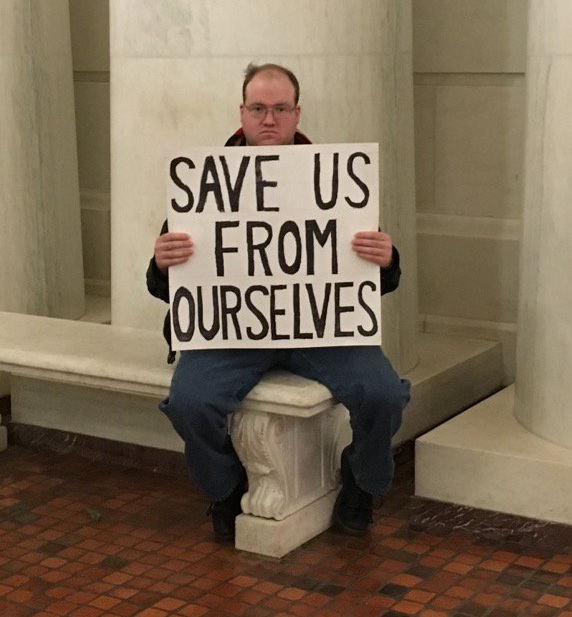

Humans destroy everything they touch. Something new is invented, and most people are afraid, so natural leaders take up its cause and make it great. Others see that this is a good thing and worth participating in, so they flock to it, but they do not alter their thinking, which fits the old way more than the new. In this way, these entryists bring the old into the new and bloat it while widening (destroying) its focus.

The old way involves what failed before, which is what humans always try because we are wired for individualism, which requires us to demand guaranteed social inclusion from any group. However, since our individualism makes us blind to the fact that other people are different from us, this includes the aggregate lot of incompetents, grifters and mental health cases that accumulate over time. Without the wisdom of Darwin to cut these people free, the human social group then submerges the new thing in the same patterns of failure that have been with us since the dawn of time.

Silicon Valley is such a case. A few engineers and managers invented the internet, but once it became commercialized, in came the fools. They wanted to do to it what they do to everything: dumb it down, remove what makes it unique, and by so doing, make it “accessible” to everyone and anyone, resulting in its genericization and thus, reduction to the same broken patterns that we see everywhere.

As a result, we are now witnessing as an oversold industry collapses from its own internal weight. The managers looked out there and saw a sea of hopeful faces belonging to those who depend on Silicon Valley for their own dreams of wealth, and so instead of contracting operations and keeping quality high, they expanded inclusiveness — becoming social heroes in the process — but adulterated quality, ensuring doom. This is what always happens with prole rule.

We know that Silicon Valley is doomed because it essentially follows the television model, where advertising pays for free services, and Silicon Valley advertising is based on a lie:

The updated results based on March 2009 comScore data…indicated that the number of people who click on display ads in a month has fallen from 32 percent of Internet users in July 2007 to only 16 percent in March 2009, with an even smaller core of people (representing 8 percent of the Internet user base) accounting for the vast majority (85 percent) of all clicks.

The news gets worse: most of those who click frequently are from the “daytime TV audience” of those living on invariant incomes of under $40,000 a year:

While many online media companies use click-through rate as an ad negotiation currency, the study shows that heavy clickers are not representative of the general public. In fact, heavy clickers skew towards Internet users between the ages of 25-44 and households with an income under $40,000. Heavy clickers behave very differently online than the typical Internet user, and while they spend four times more time online than non-clickers, their spending does not proportionately reflect this very heavy Internet usage.

In other words, a small part of the consumer base accounts for most of the internet activity, and this group represents not healthy profit from the middle classes, but the buying habits of those who have little and will achieve little. This same type of bad measurement afflicts the entertainment industry and many consumer goods and services industries, who have calibrated their content toward the lowest common denominator without realizing the limited purchasing power of this group, and consequently find themselves in slow but steady decline.

We might even see this as a design flaw of democracy. When everyone is equal, what matter is the count of warm bodies, not who these warm bodies are. Through that metric, governments and businesses attract what is seen as a large group, but is really a small group compared to the Silent Majority, and by doing this, misses actual events in favor of symbolic events that do not represent the wider, more nuanced answer.

This decline is manifesting in reduced internet advertising and the exhaustion of social media, once viewed as the future of the Western economies, which are now presumed to be “services based” instead of oriented toward the production of goods.

As these industries fade away, it makes sense to reflect on the consequences of equality which causes us to ignore the variation in our current audience. Back in the glory days of business, the buying public was a middle class comprised of relatively similar individuals. Now it is a mix of classes, races, sexes, and lifestyles/philosophies who have nothing in common, meaning that the only statistical hits we get for popularity are in these un-representative aggregates who are not the desired consumer.

Much of the dot-com censorship we see floating about now arises from the recognition by companies that their audience has shifted, and an attempt to make “safe spaces” so even more of these zombie daytime TV watchers show up, in a vain hope to produce more profit from the people who are left over once everyone else bails out.

We are already seeing this phenomenon break into the public view as both Twitter and Facebook have admitted that they mistakenly calculated more ad impressions than they delivered. The next step is for them to reveal that these ads are being seen by non-buyers.

That phenomenon has manifested itself in a loss of the blind and blithe confidence that Americans have had in the dot-com miracle, and for that reason, an increasing skepticism has led to discovery of the fraudulent nature of many dot-com businesses:

The drama has some investors predicting more disasters. “What if Theranos is the canary in the coal mine?†says Roger McNamee, a 40-year VC veteran and managing director at Elevation Partners. “Everyone is looking at Theranos as an outlier. We may discover it’s not an outlier at all.â€

Part of the problem lies in our tendency to mistake ideology for reality. We see a mental image that comports to what ideology tells us “should” be true, and then purchase accordingly, which because others follow us works for a short while. The circular Ponzi scheme allows industry to invent fake money, government to tax it heavily, and then empowers government to dump that money onto citizens through entitlements and social welfare, which they then spend on tangible goods. This keeps the economy afloat for a short while, but inevitably, a market correct begins and panic sets in as the herd searches for “the next big thing” to invest in so that we can all keep enjoying the fake value of our money.

As these different threads of the dysfunction knit together, the over-valued dot-com economy will begin its death cycle. As with earlier dot-com collapses, this will begin with a slow withdrawal by the smart money and the smarter users, then a rapidly accelerating fight over the remaining users, following by lapsing into irrelevance and being sold at low cost like MySpace.

If this hits during the first years of a Trump presidency, America will face an economic recession of massive size as the economy readjusts to cover for the fake wealth that was created by the dot-coms, especially social media. This will have rippled effects in Europe and Asia, and could result in a currency crash as it becomes clear that the economy backing those currencies was grossly over-valued and its government administrators ignored this reality.

Tags: circular ponzi scheme, collapse, dot-com, facebook, natural born clickers, recession, silicon valley, theranos, twitter