Non-Profits Get In On The Profit Game

Two famous aphorisms about asking questions come to mind.

- If you aren’t sincerely asking to learn new things, don’t ask a question you don’t at least somewhat know the answer to.

- If you think the answer is something you don’t want to deal with, don’t ask the question without being prepared for a nice, bracing shot of disappointment.

I’m sort of thinking that Charles Hugh Smith violated both rules with this post here.

Just as there are only so many hours of the day consumers can stare at screens, so too are there limits on monetizing engagement and privately owned assets. What’s left to monetize? It appears the answer is “very little.”

File under famous last words perhaps.

You asked, “What’s left to monetize? It appears the answer is ‘very little.'” I respectfully disagree. The Biggest Enchilada of all is left. Air. Specifically carbon dioxide, CO2. We just have to figure how to get the yokels to agree to pay for that which was formerly free. Got it! First we browbeat them into believing its evil and that we have to tax it to save all life on Earth. Then, following in the finest traditions of the degenerate late medieval Catholic Church, we’ll commission sellers of “Indulgences” to allow sinning at ever rising prices. a/k/a “Carbon Credit trading”. This doesn’t require any value added and the profits on “buy zero sell high” are limitless.

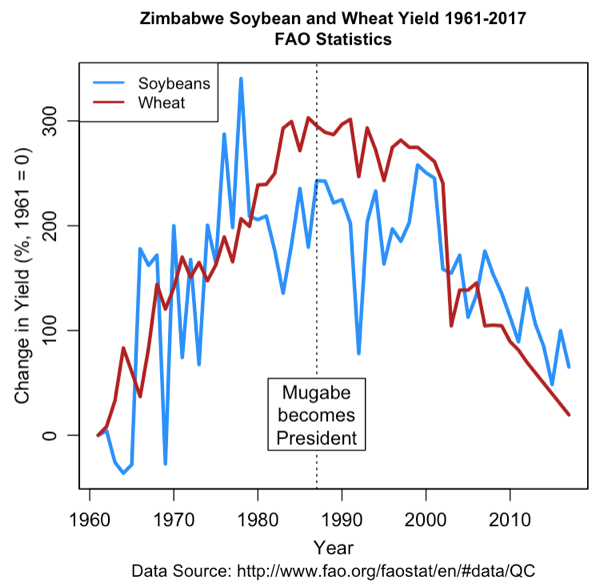

So how do make people buy into something that stupid. There won’t be enough Deutsche Banks in the world to buy up that much stupid. One thing you can do is offer up the disaster as an excuse. If Global Warming kills all your plants, you can’t blame certain leaders or political systems for declining food production. Excuses like this get made.

Consumable food calorie production from these ten crops was reduced nearly 12% (or ~-8% across all food calories) in South Africa. Large decreases in consumable food calories across all ten crops also occurred in Ghana (~-8%) in western Africa, in Zimbabwe (~-10%) in southern Africa, but increased in Tanzania (~2%) in eastern Africa (S4 Table). In some cases, as in Ghana, gains in consumable calories in maize and rice due to climate change was wiped off from losses in cassava consumable calories leading to overall decreases in consumable food calories.

Another way to convince the gullible is to convince them to use it as a weapon. They can use it as a justification to stick it to people who have more than they do. Some people will believe anything that allows them to soak “the rich.”

Transport minister Elisabeth Borne told a news conference that the €180m (£162m) it is expected to raise annually from 2020 would help finance daily transport, notably rail, in the country. The new tax will range from €1.50 for short-haul flights and up to €18 for long-haul journeys in business class.

Add in scare tactics to the mix to actually make people feel somewhat afraid. The term of the day is Climate Emergency.

Sen. Bernie Sanders of Vermont teamed up with Rep. Alexandria Ocasio-Cortez of New York and Oregon’s Rep. Earl Blumenauer on Tuesday to unveil a new resolution that would declare climate change a national emergency. “There is a climate emergency which demands a massive-scale mobilization to halt, reverse, and address its consequences and causes,” the bill’s authors wrote. While it does not call for specific action, the legislation states in sharp terms that climate change is a human-made problem that threatens the fortunes of millions of Americans and demands immediate political action.”

And it needs a certain social cache. If having Congresscelebrity Ocasio-Cortez on board isn’t good enough, get some actual celebs. Make it a meme in popular music or culture. Just to cover the entire market, make it a refuge for washed-up or discredited DC Wonks.

Do all that, and an idea, no matter how bad, no matter stupid, will never quite go away. Therefore, lots of people have plans just waiting in the drawer on how to monetize air via carbon credit trading. As early as 2009, Goldman Sachs had already cornered the proposed market in carbon emissions. They were essentially waiting for Cap-and-Trade to pass so that they could unleash one of former Goldman CEO Hank Paulson’s firm-enriching schemes.

The new carbon-credit market is a virtual repeat of the commodities-market casino that’s been kind to Goldman, except it has one delicious new wrinkle: If the plan goes forward as expected, the rise in prices will be government-mandated. Goldman won’t even have to rig the game. It will be rigged in advance. Here’s how it works: If the bill passes, there will be limits for coal plants, utilities, natural-gas distributors and numerous other industries on the amount of carbon emissions (a.k.a. greenhouse gases) they can produce per year. If the companies go over their allotment, they will be able to buy “allocations” or credits from other companies that have managed to produce fewer emissions: President Obama conservatively estimates that about $646 billion worth of carbon credits will be auctioned in the first seven years; one of his top economic aides speculates that the real number might be twice or even three times that amount. The feature of this plan that has special appeal to speculators is that the “cap” on carbon will be continually lowered by the government, which means that carbon credits will become more and more scarce with each passing year. Which means that this is a brand-new commodities market where the main commodity to be traded is guaranteed to rise in price over time. The volume of this new market will be upwards of a trillion dollars annually; for comparison’s sake, the annual combined revenues of all electricity suppliers in the U.S. total $320 billion.

So nobody outside of one or two profoundly deluded nuts really believes that our current anthropogenic spate of ecodie is the result of Global Warming. Just look at how Climate Celebrities behave. Things like habitat set-asides and an end to social programs that prop up the survival and encourage breeding by irresponsible and incapable humans don’t line wallets. Guarunteed bubbles like mandated carbon exchanges do the damage. Particularly if you can make a market where the prices are artificially inflated by design.

There will always be some way to flense the idiots. Like PT Barnum’s sign reading “This way to Egress,” the shameless will show no shame in how they will bilk the system. As one racket goes bust-out, another always forms. Goldman Sachs’ strategy to monetize hot air is just par for Amerika’s downward, declining course. It reminds me of a lyric from an old enviro-scare song from the 80s.

Buy the sky, and sell the sky

Tags: NGOs, non-profits, speculation